Health

The Impact of Debt on Mental Health

Having debt is extremely common in the United States. In fact, most people currently have some type of debt. There are a variety of reasons for this, including the fact that debt is often used to finance things like education and housing. There are many different types of debt, including credit card debt, student loan debt, and mortgage debt. Each type of debt can have a different effect on your finances. What many people don’t realize is that debt can also have an effect on your mental health. Experts say that financial stress can be particularly difficult to deal with. If you want to learn more, keep reading to find out about the impact of debt on your mental health.

What is the impact of debt on mental health?

First, you should know that you aren’t alone and that there are products and services that can assist you. One example is debt consolidation, which can be done through a business like Citizens Debt Relief. Debt consolidation can be an extremely beneficial process for those who are struggling with debt. When you consolidate your debts, you are taking all of your various debts and combining them into a single, more manageable loan. This can make it easier to keep track of your payments, and it can also make your monthly payments more affordable, which can make you feel more in control of your financial situation.

For many people, debt feels like a weight they can’t shake. People who are in debt are generally more likely to experience anxiety, depression, and a broad range of other mental health issues. The reality is debt can cause stress. It can make people worry about their finances and feel like they are not in control of their lives. This can lead to feelings of anxiety and depression. Additionally, having too much debt can be overwhelming and lead to feelings of hopelessness. All of these factors can negatively impact mental health.

If your debt is affecting your mental health, it’s crucial to get professional help. A therapist can offer guidance and provide you with the support you need to stay on track as you start to repay your creditors. Therapy can also give you the tools you need to manage your mental health and deal with symptoms associated with common mental health conditions.

What other lifestyle factors can affect your mental health?

Sleep deprivation can significantly affect your mental health. It can elevate your likelihood of developing conditions like anxiety and depression, as well as cause fatigue and irritability. If you’re not getting enough sleep, it can be hard to focus at work or school, and you may be more likely to get into accidents. Sleep deprivation can also lead to mood swings and changes in your personality. You may become more forgetful, and your ability to think clearly may be impaired. You need to get enough sleep if you want to be at your best. If you’re struggling to fall asleep consistently, you should talk to your doctor about finding a solution.

There is a growing body of evidence that suggests that exercise can have a positive effect on your mental health. Exercise can boost your mood, elevate your energy levels, and make you feel more alert and focused. Additionally, exercise has been shown to reduce stress and anxiety, and can even improve sleep quality. Exercise can be a helpful supplement to other treatments, such as therapy or medication. However, note that exercise should not be used as a replacement for traditional mental health treatments. Rather, it should be used as an additional tool to manage your mental health.

As you can see, there are many ways that debt can play a role in your mental and emotional health. Being in debt has long been linked to mental health conditions like depression, anxiety, and panic disorder. The good news is that there are many things you can do to tackle your debt problem and protect your mental health. Therapy is a valuable resource that you should take advantage of. Making healthy lifestyle choices is essential too, like getting plenty of sleep at night and incorporating exercise into your daily routine. If you follow the tips in this article and make a concrete plan to attack your current debt, you’ll be in a better financial situation before you know it.

-

Latest News3 years ago

Latest News3 years agoSoap2day Similar Sites And Alternatives To Watch Free Movies

-

Software3 years ago

Software3 years agoA Guide For Better Cybersecurity & Data Protection For Your Devices

-

Android2 years ago

Android2 years agoWhat Is content://com.android.browser.home/ All About? Set Up content com android browser home

-

Blog2 years ago

Blog2 years agoMyCSULB: Login to CSULB Student and Employee Portal

-

Android App3 years ago

Android App3 years agoCqatest App What is It

-

Android App3 years ago

Android App3 years agoWhat is OMACP And How To Remove It? Easy Guide OMACP 2022

-

Business3 years ago

Business3 years agoKnow Your Business (KYB) Process – Critical Component For Partnerships

-

iOS2 years ago

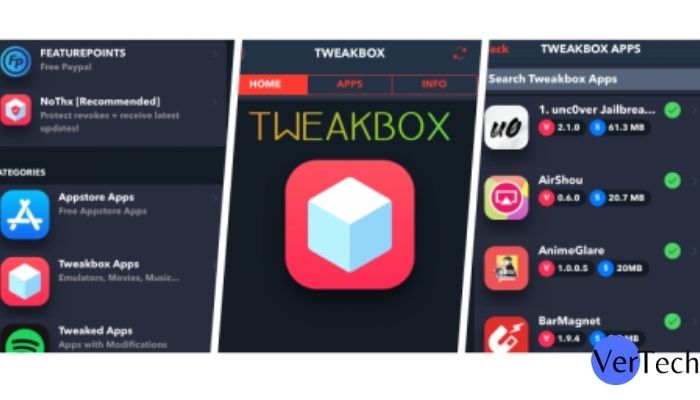

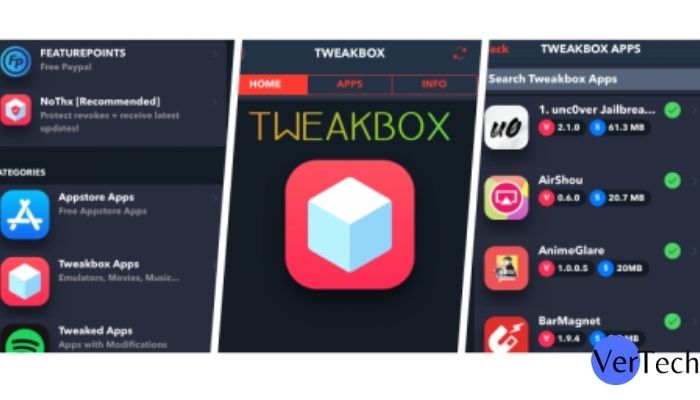

iOS2 years agoTweakBox App – Best App for iPhone [Jan, 2023] | (iOS 15, Download, 2023)