Business

Why Open A multi-Currency Account For Your Business

Do you transact in multiple currencies regularly? Are you currently maintaining accounts in currencies different from your home currency? Is it starting to feel like a hassle to keep track of them all from different banks, even with the help of spreadsheets? These are all telltale signs that an alternative currency account is needed. But why would a business need an alternative currency account?

It may be that you are operating from an international location, your business is involved in cross-border trade, or you are a company based in the EU and need two accounts for your operations. The convenient thing about this is opening a multi-currency account for your business. Here are some reasons you may want to consider opening a multi-currency account:

Operating Internationally

Think of the expenses involved in keeping the accounts from various banks and having them transferred or having different currency amounts paid directly into the accounts. It could turn out to be an expensive and inconvenient process. Having a multi-currency account would allow you to keep all your accounts from different banks in one location and an online interface for easy access.

Cross-Border Trade

You can easily use a multi-currency account for cross-border trade. Business owners have found this especially useful for the accounting aspect of their business, allowing them to keep track of their business finances from all over the world, as well as an online interface for easy access.

Asian based companies

A multi-currency account allows Asian-based companies to have an overview of their finances and the convenience of a single currency while ensuring compliance with all local tax laws.

A multi-currency account can still be useful even if you are not operating from an international location or involved in cross-border trade. If you find yourself using spreadsheets just to keep track of your accounts and finances for your business, then this is another sign that it is time for a multi-currency account.

When you open multi currency account with the same financial institution you are already using for your normal bank account, there is less to worry about, especially if you have an existing relationship with them. The security and safety of the bank are ensured, and the convenience of having all your accounts in one location. This will ensure:

- Your corporate funds are always in the most appropriate currency.

- The account is compliant with all local tax laws.

- You can perform online banking and bill payments from any computer terminal, anywhere in the world.

- You can benefit from the fast cash transfer and money transfer features.

- You can easily monitor your daily trading activities and keep them fully up-to-date.

It will also allow you to perform currency conversion in the most efficient way possible, which is often critical for business owners.

You can also see a list of many of the Asian banks that offer multi-currency accounts, including FXCM. Contacting your current bank to find out if they have a multi-currency account before signing up with another one will save you time.

-

Latest News3 years ago

Latest News3 years agoSoap2day Similar Sites And Alternatives To Watch Free Movies

-

Software3 years ago

Software3 years agoA Guide For Better Cybersecurity & Data Protection For Your Devices

-

Android2 years ago

Android2 years agoWhat Is content://com.android.browser.home/ All About? Set Up content com android browser home

-

Blog2 years ago

Blog2 years agoMyCSULB: Login to CSULB Student and Employee Portal

-

Android App3 years ago

Android App3 years agoCqatest App What is It

-

Android App3 years ago

Android App3 years agoWhat is OMACP And How To Remove It? Easy Guide OMACP 2022

-

Business3 years ago

Business3 years agoKnow Your Business (KYB) Process – Critical Component For Partnerships

-

iOS2 years ago

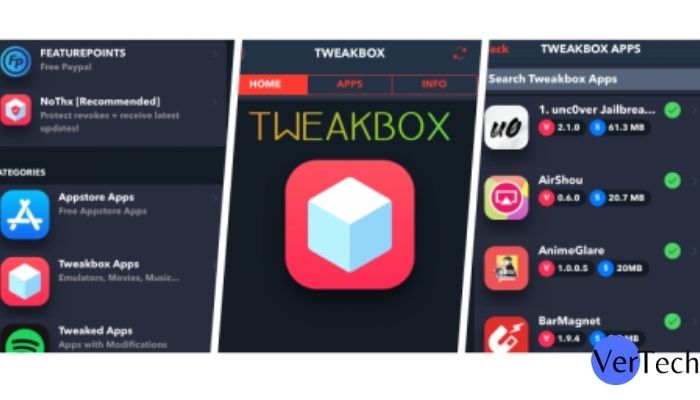

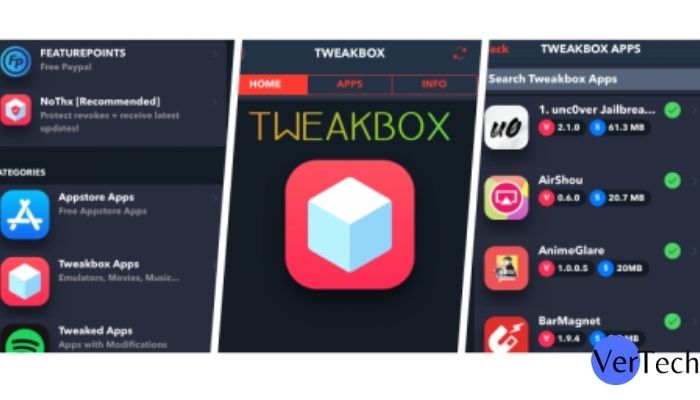

iOS2 years agoTweakBox App – Best App for iPhone [Jan, 2023] | (iOS 15, Download, 2023)