Business

What Considerations Should You Make When Choosing a Direct Payday Lender Like PaydayChampion?

The bank loan application procedure is extensive and requires pre-approval and documents. Direct payday lenders without a middleman may prevent you from getting these problems. Direct consumers do not use a third party to verify their identity, drastically reducing the time required to get a loan.

Payday loan direct lenders

Contact a direct payday lender if you’re stuck and need money quickly. Requests for payday loans are processed internally by this kind of lender, and they do not disclose customers’ personal information to any other financial institution. You may often apply this application form right away, and the money you need will be sent to you within a few days.

Payday loans lenders like PaydayChampion are also available for short-term borrowing and do not provide long-term financial solutions. It is among the most straightforward techniques for getting financial aid over a short period, and approval is given immediately away.

Requirements for direct payday loan approval

Another benefit of acquiring a loan from such a direct payday loan bad credit loans guaranteed approval NZ without the involvement of a third party is that there are no rigorous conditions for consumers. In contrast to banks, direct borrowers do not worry about their credit score or past.

To approve a personal loan application, a direct borrower will look at your income and job status.

The firm will also want information about your bank account to pay money directly to you.

Payday loan providers that do not need proof of income and offer meager loan amounts or interest rates should be avoided. They are likely to be con artists who will not give you any money.

Payday lenders from a professional payday loan are available online.

Using a direct online lender is one of the easiest methods to get cash. Payday lenders with no third-party participation enable you to receive some money quickly while you’re in a financial emergency.

I am applying for online loans shielding you from the more formal aspects of the lending procedure, saving you time and energy.

No-teletrack direct payday lenders

A payday loan is a high-cost, relatively brief loan that the borrower repays with their next paycheck. Because it can be accessed online, this is a quick and easy method. Furthermore, you do not need to give your credit history or score to get a payday loan.

What is the process of getting a payday loan?

To ensure your solvency, you must supply your earnings and current account details to the payday lenders. After filling out the payday loan application, you will be required to sign a document authorizing the withdrawal of cash from your bank account on the next payday. The lender will usually issue you a private loan after verifying the details the same day.

Direct payday lenders don’t use teletrack and don’t need a credit check.

If the loan is taken out at a shop, the lender will set up a time to repay the funds. If you don’t show up, the lender will do a credit check or charge you the whole amount of the loan plus interest. Online lenders use electronic withdrawals.

The price of a payday loan

Although it is a relatively quick method of borrowing money, it is also highly costly. A payday loan typically costs $ $15 for every $100 borrowed. In reality, for a two-week loan, this is 391 percent.

There are no third-party payday lenders, so if you have a negative credit score, you may use

If you do not repay the whole amount of the loan, you will be charged a percentage. As a result, there is a risk of paying more than the initial loan amount within a few months.

As a result, payday digital internet loans are regarded as a high-risk instrument: you may quickly get into a debt spiral, but getting out of it will be tough.

Factors that Should be considered When Choosing a Payday Loan Website

When looking for the best internet payday lender, payday loan applicants should examine the following characteristics from Mirek Saunders of PaydayChampion to reduce the chance of unsuccessful or fraudulent transactions:

The company’s reputation is at stake. First and foremost, listen to what other consumers say about this online lender. Check to see whether the business is real and how old it has been in business.

It’s time to get some money. It’s essential to look at the company’s history of making timely payments upon personal loans since the quickness of transactions is crucial in an emergency.

Conditions of Use. When searching for an internet lender, it’s essential to pay attention to the qualifications and terms that payday loan organizations give when providing online payday loans. Before signing the contract, read the information provided by the loan provider. This may include facts like interest rates, monthly bills, terms, and other information.

Confidentiality and safety are paramount. Choose an online lender that can ensure the protection of your personal information. To do so, check the lending process’s privacy policy and ensure that your encrypted data.

Transparency. If a corporation isn’t upfront about its services, you may be charged money or fees that aren’t disclosed. Fake businesses use expensive internet advertising campaigns to entice clients before tricking them into giving over their personal information.

There are no third-party payday lenders, and there is no credit check.

Payday loans may be an essential and easy tool to help you get out of debt, but only until you can repay the money quickly. If you decide to take out a payday loan, your evaluation criteria will help you choose a reputable online lender that would treat you fairly and won’t put you in even more debt.

-

Latest News3 years ago

Latest News3 years agoSoap2day Similar Sites And Alternatives To Watch Free Movies

-

Software3 years ago

Software3 years agoA Guide For Better Cybersecurity & Data Protection For Your Devices

-

Android2 years ago

Android2 years agoWhat Is content://com.android.browser.home/ All About? Set Up content com android browser home

-

Blog2 years ago

Blog2 years agoMyCSULB: Login to CSULB Student and Employee Portal

-

Android App3 years ago

Android App3 years agoCqatest App What is It

-

Android App3 years ago

Android App3 years agoWhat is OMACP And How To Remove It? Easy Guide OMACP 2022

-

Business3 years ago

Business3 years agoKnow Your Business (KYB) Process – Critical Component For Partnerships

-

iOS2 years ago

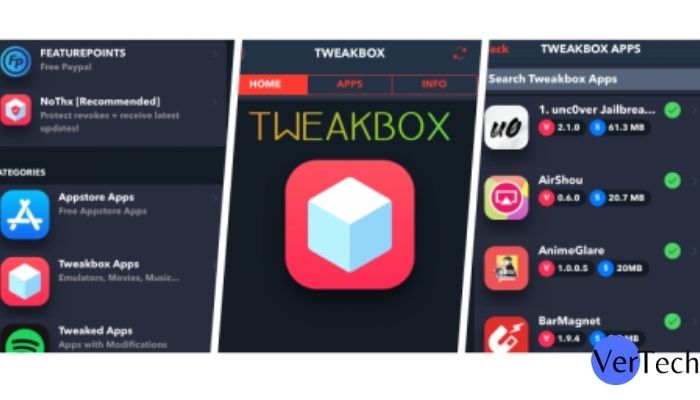

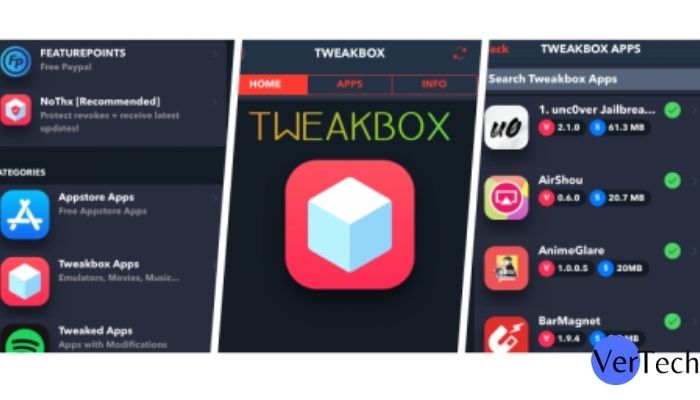

iOS2 years agoTweakBox App – Best App for iPhone [Jan, 2023] | (iOS 15, Download, 2023)